Most accountants didn’t get into finance so they could fight with Excel formulas or chase coworkers for missing receipts.

But here we are—every week—copying cells, cleaning dollar signs, matching vendors, and hoping that column G isn’t misaligned again. That’s where a new wave of AI tools comes in. They don’t just “look smart.” They actually get stuff done.

Here are some of the best AI-powered tools you can use right now to make accounting and expense workflows cleaner, faster, and just less annoying. Whether you’re closing the books, auditing expenses, or just trying to find out who submitted the same invoice twice—this stack will help.

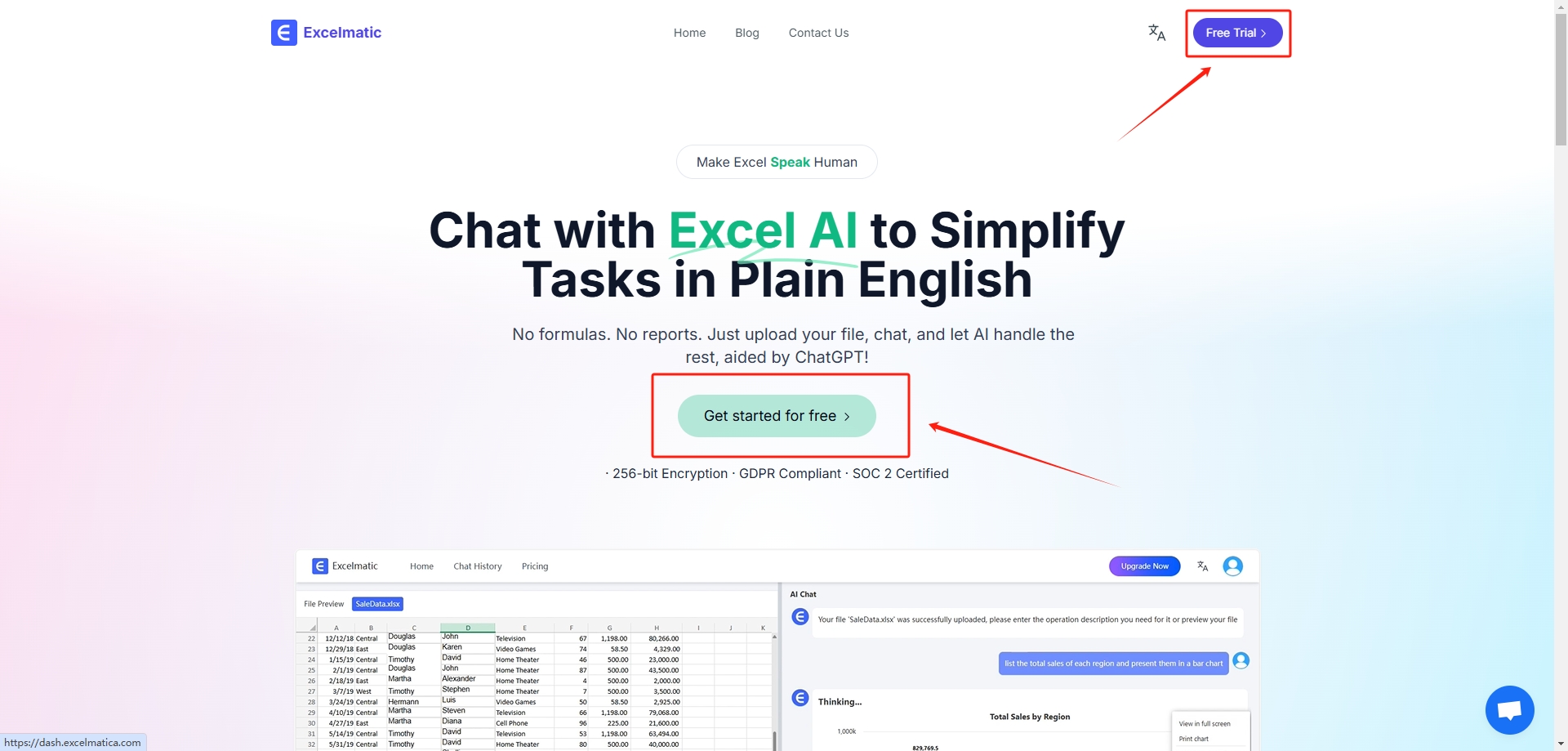

1. Excelmatic

If you're still using Excel for reimbursements, budget tracking, or monthly close tasks (and let's be honest—who isn’t?), Excelmatic is the external AI tool that makes Excel files smarter—without changing how Excel itself works.

You upload your spreadsheet—maybe it's messy, full of multiple currencies, inconsistent categories, or text-wrapped dates—and just type:

Summarize monthly expenses by category.

Find duplicate vendor payments over $1000.

Flag claims missing cost centers.

In seconds, you get clean output: grouped tables, totals, even visual summaries. It handles cleaning, formatting, cross-field validations, and chart generation—all based on plain English prompts.

It’s especially good for teams buried in spreadsheets but without time to learn macros, Power Query, or Python. You’ll get more out of your data, with less time figuring out how.

Pricing: Free plan available; Basic version starts at ~$5.99/month

Best For: Accountants, bookkeepers, or expense reviewers working in Excel all day

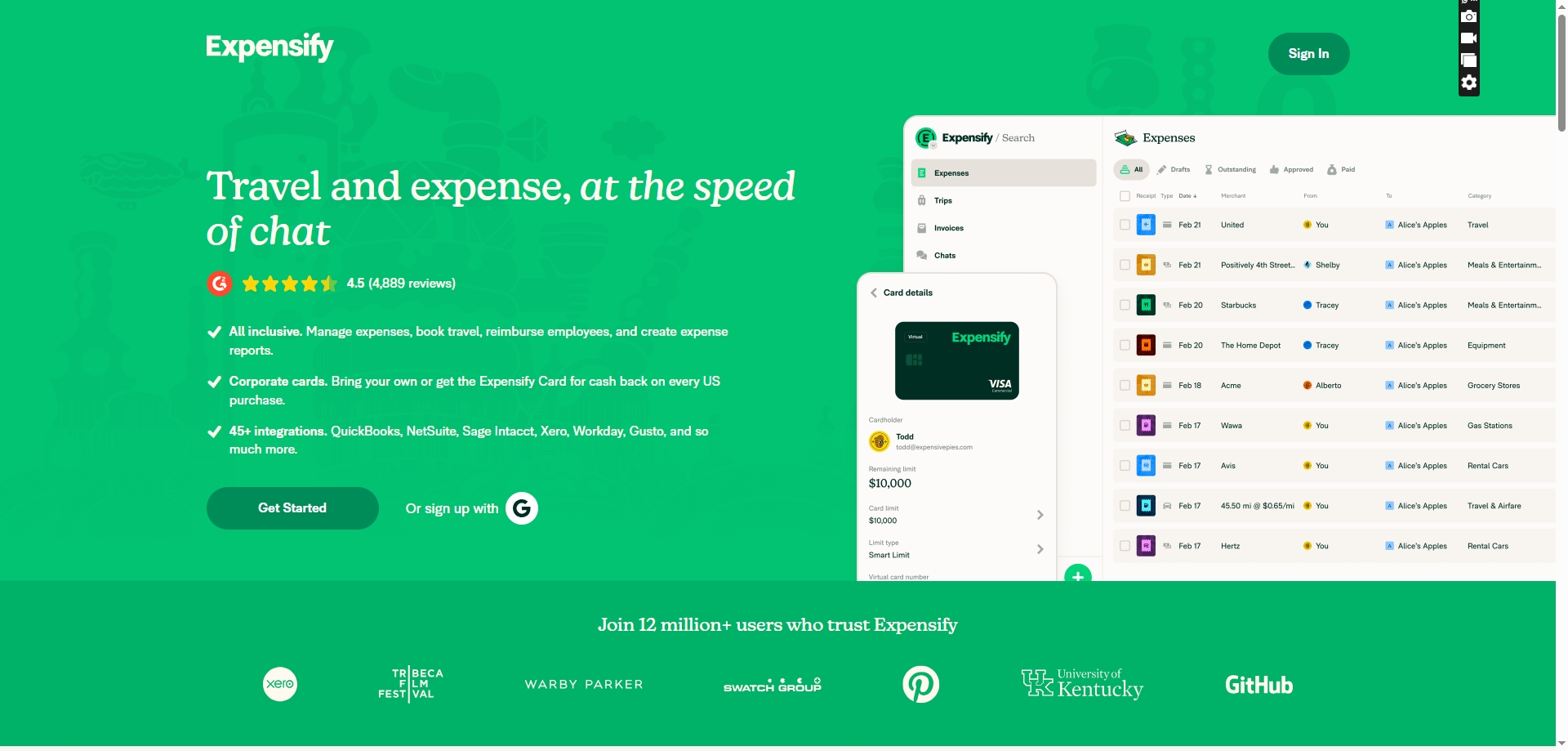

2. Expensify

We’ve all heard the pitch: “Snap a photo, get reimbursed.” But Expensify actually delivers on this with one of the smoothest mobile-to-ERP pipelines in the market.

Employees snap receipts. Expensify scans them using OCR, categorizes the expense, auto-fills the report, and submits it. Finance sees structured reports that sync with QuickBooks, NetSuite, or Xero. It's not magic—but it's close.

Pair this with Excelmatic and you have a powerful pipeline: Expensify captures and structures data, Excelmatic slices and analyzes it for audit, policy, or variance detection.

Pricing: Free for personal use, starts at ~$5/user/month for teams

Best For: Companies with mobile teams or high reimbursement volume

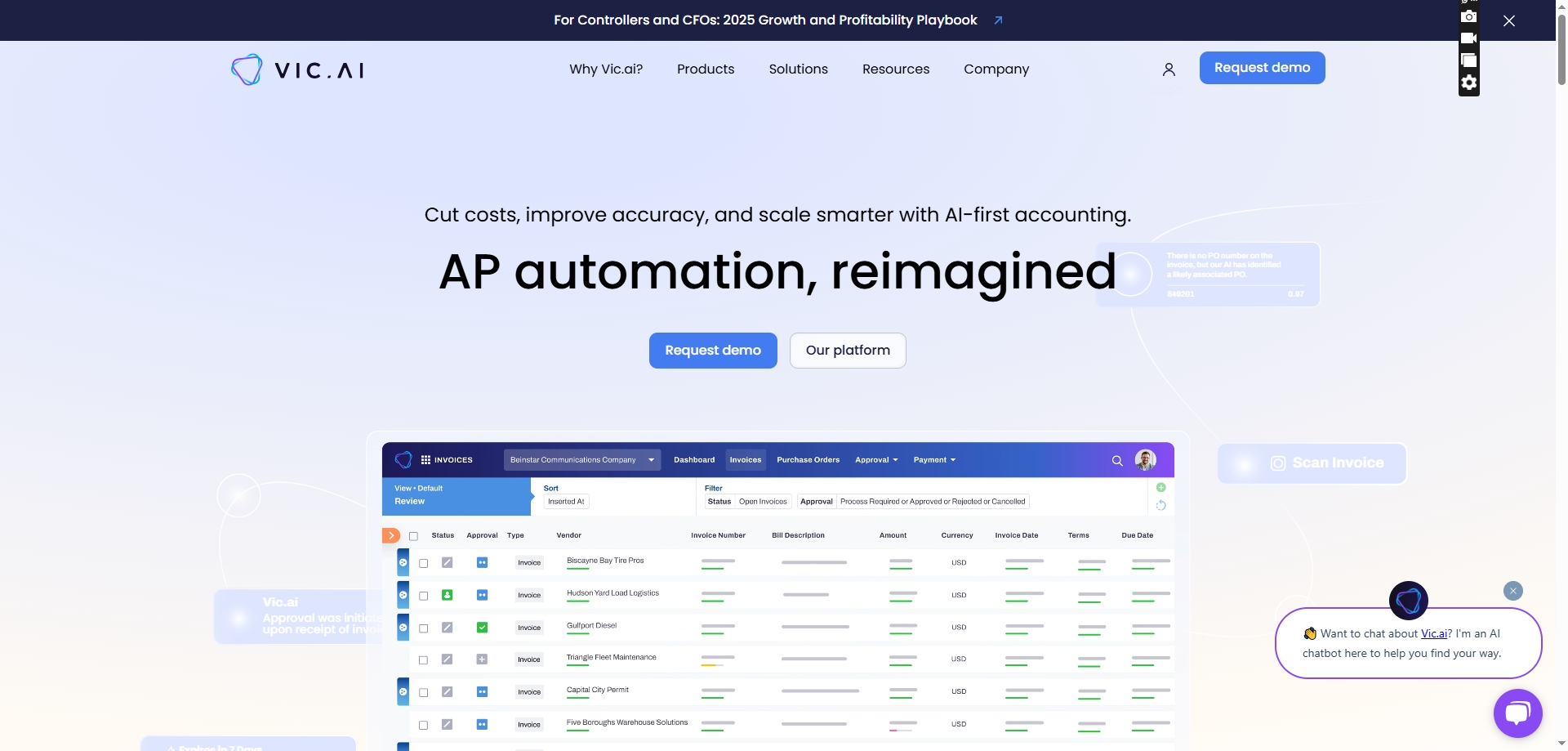

3. Vic.ai

Vic.ai is like giving your AP process a brain. Instead of just scanning invoices, it learns how your team classifies, codes, and approves them—and then starts doing it for you.

It pulls in invoices, extracts data with deep-learning OCR, and auto-suggests GL codes, approvers, and vendors. Over time, it gets smarter—spotting anomalies and preventing duplicate payments before they hit the books.

If Excelmatic is great for working with outputs and summaries, Vic.ai is brilliant for automation at the intake stage.

Pricing: Custom quotes; best suited for teams processing >1,000 invoices/month

Best For: Medium-to-large finance teams drowning in vendor invoices

4. Ramp

Ramp isn’t just a corporate card—it’s a full spend platform. You get real-time transaction visibility, built-in approval workflows, vendor insights, and expense rules that flag out-of-policy spend before the swipe goes through.

Its AI learns spending patterns and can recommend savings, negotiate contracts, and detect redundant SaaS subscriptions. Unlike Excel audits that are always reactive, Ramp helps you control expenses before they happen.

Think of Excelmatic as your data analysis backend. Ramp is your live firewall at the front.

Pricing: Free (Ramp earns on card interchange)

Best For: Growing companies managing budgets, vendor contracts, and team-level spend

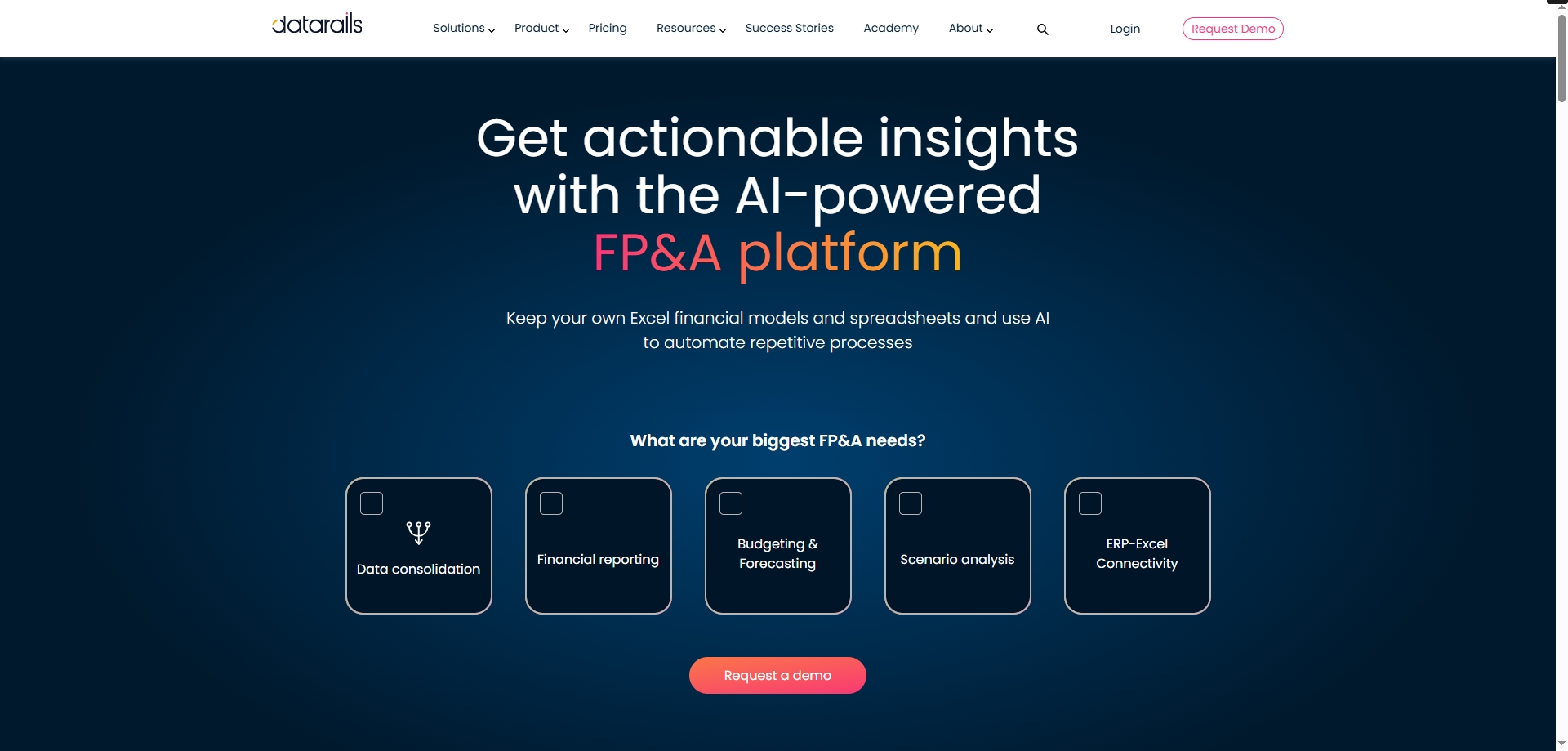

5. Datarails

If your finance team lives in Excel but wishes they had FP&A-grade models, dashboards, and audit trails—without learning a BI tool—Datarails is for you.

You connect your existing spreadsheets to their platform. Datarails adds version control, data integration, consolidation, and scenario planning on top. It's like upgrading Excel with a brain, a memory, and a data pipe.

Use Excelmatic to explore data and find anomalies. Use Datarails to manage forecasts, team inputs, and board-ready outputs.

Pricing: Custom quote (targeted at mid-market and enterprise)

Best For: FP&A teams who need more control and less manual consolidation

Final Thoughts: Pick One or Stack Them

No, you don’t need to use all of these. But the magic is in the mix.

Use Expensify to capture expense data. Let Vic.ai process invoices before they hit your GL. Run spend control through Ramp. Clean and analyze with Excelmatic. Forecast in Datarails.

Each tool solves one bottleneck. Together, they give finance teams something rare: time back.

And when was the last time you heard an accountant say they had extra time?